A tax lien business can be a profitable way to earn income while helping others improve their financial situations. By becoming a tax lien investor, you can purchase properties with delinquent taxes for a fraction of their value and then work with the owners to help them pay off the debt and keep the property. While there is some risk involved, tax lien investing can be a great way to make money and make a difference in your community.

Tax Lien Side Hustle

Tax lien investing could be a great side hustle because you don’t need to give it constant hours rather than you can find some time after work or during weekends to do most of the research and outreach!

Requirements

The only requirement is that you must have some cash ready to invest on the tax lien certificates. This might be a good side hustle to start with a few of your friends, each of you could put some money in to make it affordable!

Tax Lien investment could be a great side hustle because it doesn’t require you to put daily hours, instead, you can properly spend few hours a weekend and get it done.

In this Guide, we will learn everything you need to know about starting and investing in a tax lien business.

What Is A Tax Lien?

A tax lien is a legal claim the government can make on your property if you owe back taxes. The lien gives the government the right to take your property in order to satisfy the debt.

As the owner of the lien, you are then entitled to collect the unpaid taxes, plus interest and penalties.

This happens when someone cannot pay their property tax, but the government wants their revenue from anywhere possible. This is when you come in and pay the tax and take over the lien, so the property owner is obligated to pay you within 60-90 days, depending on the state with some sort of interest in full.

Steps To Starting Tax Lien Business

Research Tax Lien Laws

Each state has different laws governing tax liens, so you’ll need to be familiar with the rules in your state. You will need to get familiar with these laws so that you are not breaking the or worse case harassing the property owners in a way that’s not allowed, which could lead you into more trouble because they could file lawsuit against you.

Some common Tax Lien Laws are:

- Send all communication via Trackable Mail

- Refrain from using Foul Language

- Be Respectful to the property owner

- Get Everything Documented

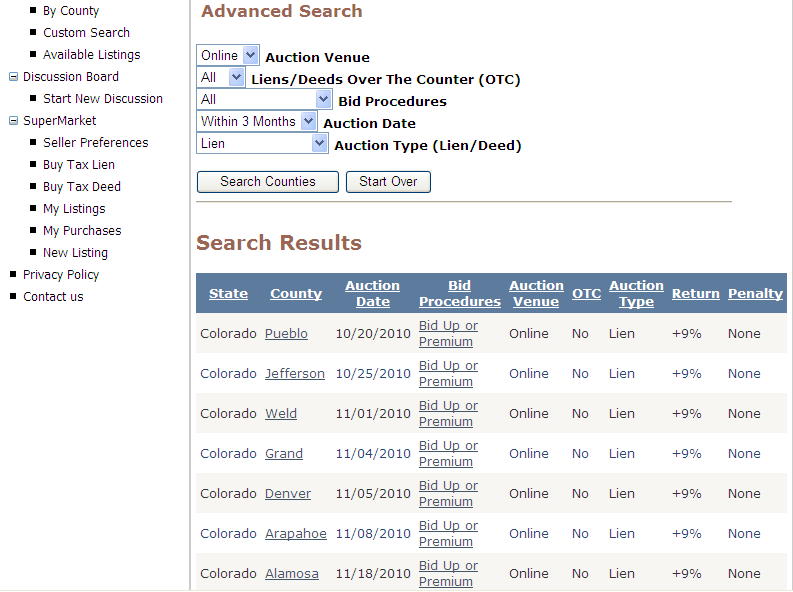

Find Properties With Unpaid Taxes

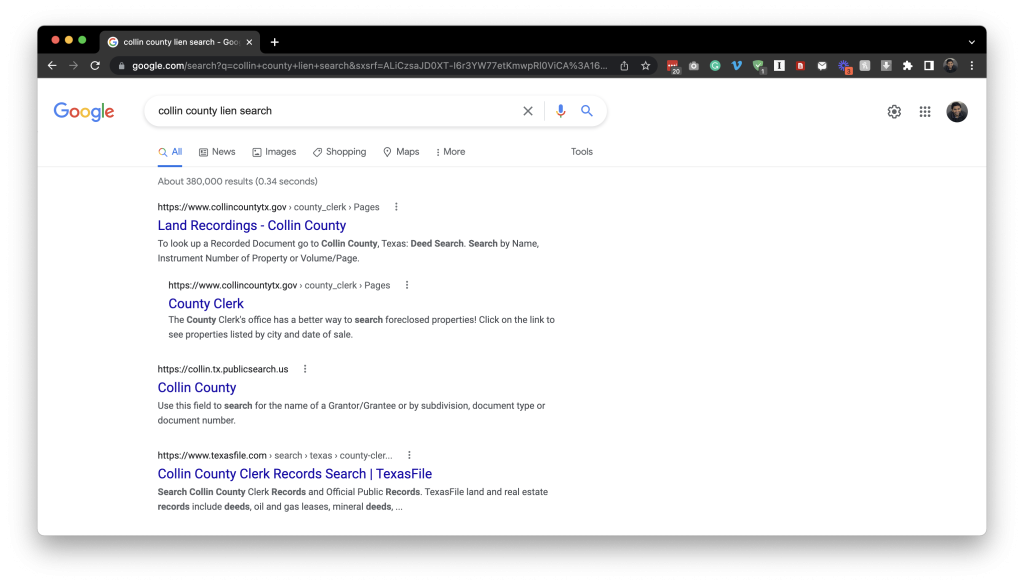

You can search your county’s public records to find properties with unpaid taxes. Most of the time, if you google ” [County Name] Tax Lien” you will be able to find properties with unpaid taxes.

This is probably the “hardest” part about tax lien business because you will need to find these properties, and in many cases, you won’t be able to get a penny out of the property owner after doing some research, so its all about being able to hunt down the right “deal”.

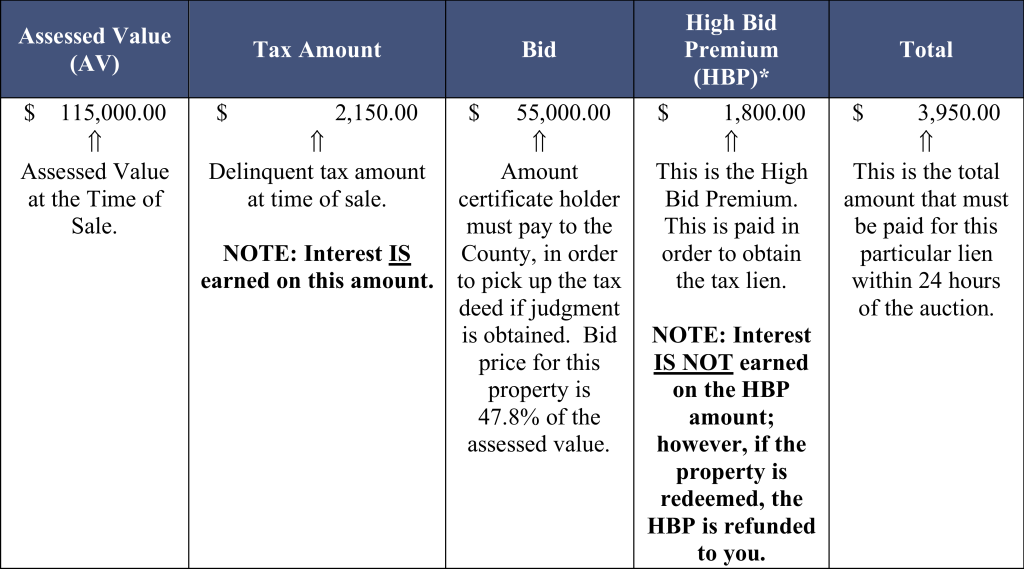

Bid On Tax Liens

When you find a property with unpaid taxes, you can then place a bid on the lien. This is often done online where you will place a bid amount compared to the amount owed.

Make sure that you are not bidding the whole amount owed because you might not have enough margins to make it worthwhile. You should aim to bid about .20-.30 Cents per dollar on low-end properties and and up to .75 cents on better high end properties.

Collect Payment

Once you’ve won the bid, you’ll need to collect the unpaid taxes, plus interest and penalties, from the property owner.

This could be very easy if the owner simply forgot or if the property is high end and if the owner simply doesn’t have the means then you might want to workout a payment plan with the owner to help them out.

Frequently Asked Questions

How do tax liens work in Colorado?

A tax lien is a legal claim that a government entity makes against a property owner’s real or personal property when the owner fails to pay their taxes. The lien gives the entity the right to collect the unpaid taxes, plus interest and penalties, from the property owner. If the property owner does not pay the taxes owed, the government entity can foreclose on the property and sell it to recoup the taxes owed.

What is the best state to buy tax lien certificates?

Florida is the best state to buy tax liens because the maximum interest that you can charge is almost 18%, while Arizona has 16%.

How do I find tax-delinquent properties in my area?

There are several ways to find tax delinquent properties, One way is to contact your local tax assessor’s office and ask if they have a list of properties that are behind on their taxes. Another way is to search your county’s public records for tax liens. Finally, you can search for tax delinquent properties online using a service like PropertyShark.

Tax Lien Investing Pros And Cons

There are a number of pros and cons to tax lien investing. Some of the pros include the potential for high returns, the fact that tax liens are a relatively safe investment, and the fact that they can be a good source of passive income. Some of the cons include the fact that tax lien investing can be a bit of a hassle, and that you may not always be able to find good deals on tax liens.